In basic conditions, Capital Gains On Investment Property would be your gap between the gross sales cost and also the price of improvements and purchase. Capital gains are taxed at a pace, that will be a speed, that will be 15 percentage

In basic conditions, Capital Gains On Investment Property would be your gap between the gross sales cost and also the price of improvements and purchase. Capital gains are taxed at a pace, that will be a speed, that will be 15 percentage

Compute Gains

Capital Gains On Investment Property for being a formula can be your own earnings cost minus initial purchase price earnings charges and also the price of financing improvements. In the event you purchased a rental property for $500,000--that comprises a number of one's costs related to buying just like legal professional fees and mortgage factors--marketed it for £800,000, paid out land commission of £40,000 in the purchase price, place £50,000 of developments into the residence and maintained £20,000 in depreciation within the previous four decades, you'd wind up owing taxes on roughly £190,000 of funding profit ($ $800,000-£500,000-£40,000-£50,000+£20,000=$ $190,000). Assuming you held than just a calendar year, 1-5 percentage tax would be owed by you .

Suspending the Legislation by Exchanging Asset

Section 1031 of the IRS code gives you the ability to offer investment land and apply the proceeds to purchase a residence without even spending any taxation. That really is known as a like-kind or 1031 (following the IRS code department) market. There are rules which direct time conditions such as purchasing and identifying the substitute residence and also the 1031 course certainly need your

Additional Capital Benefits Factors

Capital profits and capital profits levels are pertinent to investments including shares. Additionally they trade

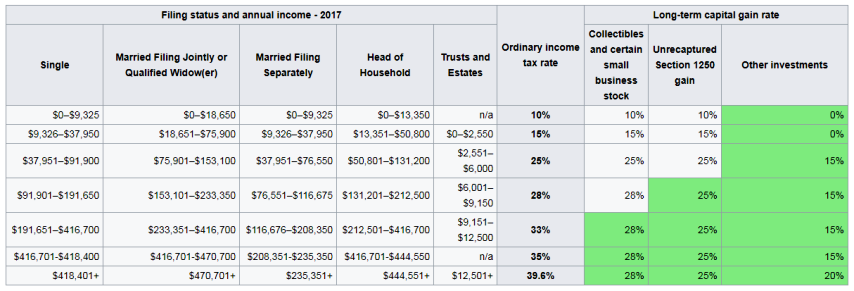

At the time of 2017, the USA taxation short term funding gains in an identical speed since it taxation average revenue (view exclusion). Some funding profits are taxed at reduced rates

The taxation on collectibles and selected small business inventory is capped at 28 percent.

The taxation on unrecaptured

The taxation on the majority of other investments will be in a preferential amount of 0 percent, 15 percent, or 20 percent, based on the tax rate which will be evaluated on an identical sum of average revenue. (Or competent dividends get precisely the exact same taste.)

The dollar sums ("tax mounts") have been corrected annually depending on inflation, and also therefore are later exemptions and deductions, meaning that there's just another mount, of cash flow under that revealed as £ 0 at the desk, to which no tax is expected. To get one citizen picking the conventional deduction at 20 17, this number is $10,400.

No comments:

Post a Comment